Income tax calculator adp

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

2

Get Your Quote Today with SurePayroll.

. For example if your employer offers a two-tiered program with a 100 match on contributions of. Important Note on Calculator. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of 625. For instance a paycheck calculator can calculate your employees gross earnings federal income tax withholding Medicare and Social Security tax and final take-home pay.

All Services Backed by Tax Guarantee. Income and Salaries for Fawn Creek - The average. Marginal tax rate 633.

Important Note on Calculator. The US average is 46. Important Note on Calculator.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Discover Helpful Information And Resources On Taxes From AARP. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Get Started Today with 2 Months Free. Our Premium Calculator Includes. A Beginners Guide To Imputed Income.

Effective tax rate 561. New York state tax 3925. The states income tax rate is only one of a handful of states that levy a.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. - Tax Rates can have a big impact when Comparing Cost of Living. But calculating your weekly take-home pay.

Important Note on Calculator. In addition to wages salaries commissions fees and tips this includes other forms of compensation such as fringe benefits. Ad Try Our Free And Simple Tax Refund Calculator.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. 100 Accurate Calculations Guaranteed. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

- The Income Tax Rate for Fawn Creek is 57. Total income tax -12312. If so enter the appropriate percentage of match for your desired level of contribution.

How Your Paycheck Works.

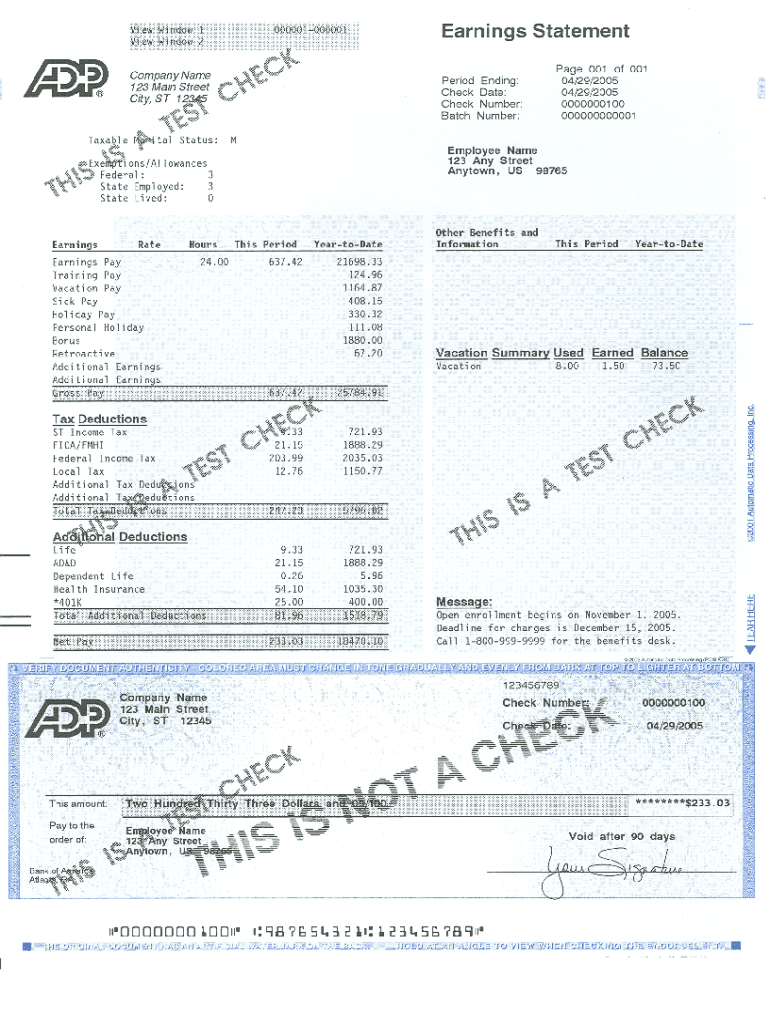

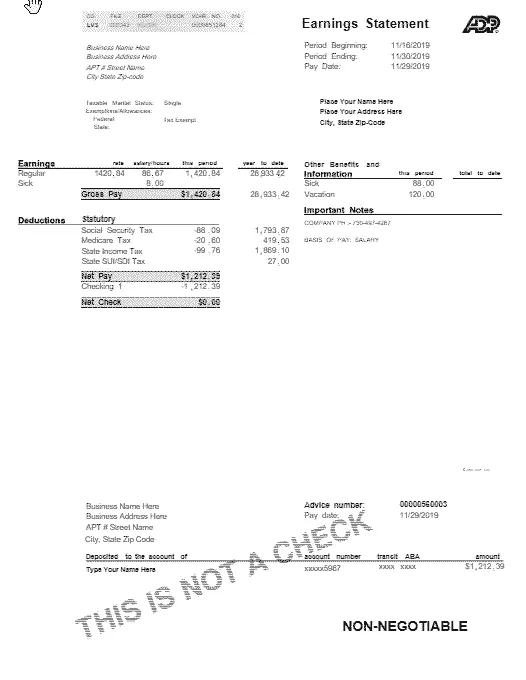

Adp Earning Statement Sample Fill And Sign Printable Template Online

2

Will Bears Rule Adp Stock Post Earnings

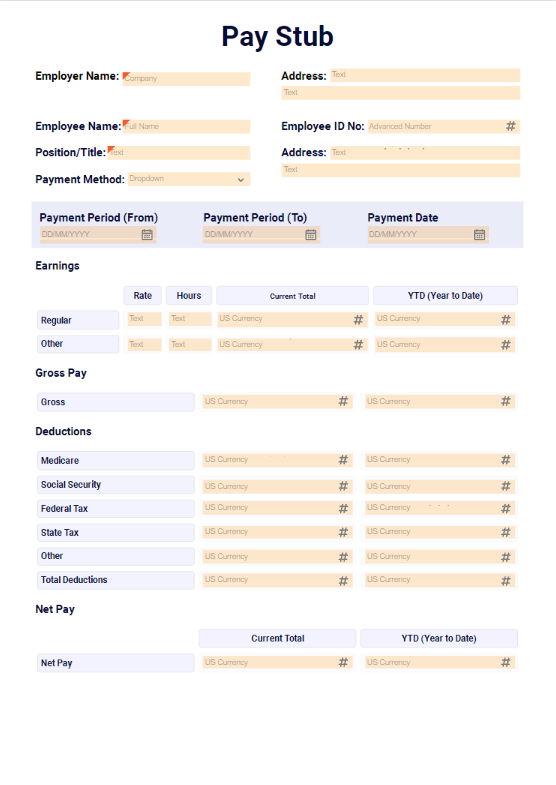

Adp Check Stub Maker Without Coding Airslate

Payroll Cost Payroll Service Costs Adp Canada

Adp Salaries Comparably

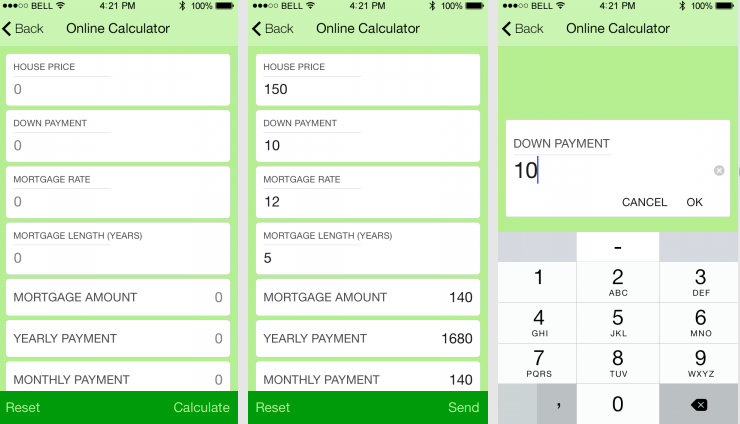

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Find Your W2 On Adp Atlas Daily 421 Youtube

Gross Pay Calculator Adp

2

2

Adp Pay Stub Copy Generator Pdfsimpli

Adp Payroll Pricing And Fees 2022 Guide Forbes Advisor

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Payroll And Tax Resources Employment Tax Adp Canada

Pin On Payroll Checks

Payroll Processing Services Rgb Accounting Toronto On